car repair insurance companies: features, safety, and long-term impact

What they actually cover

These policies pick up repair bills after sudden mechanical or electrical failure. Not routine maintenance. Not cosmetic fixes.

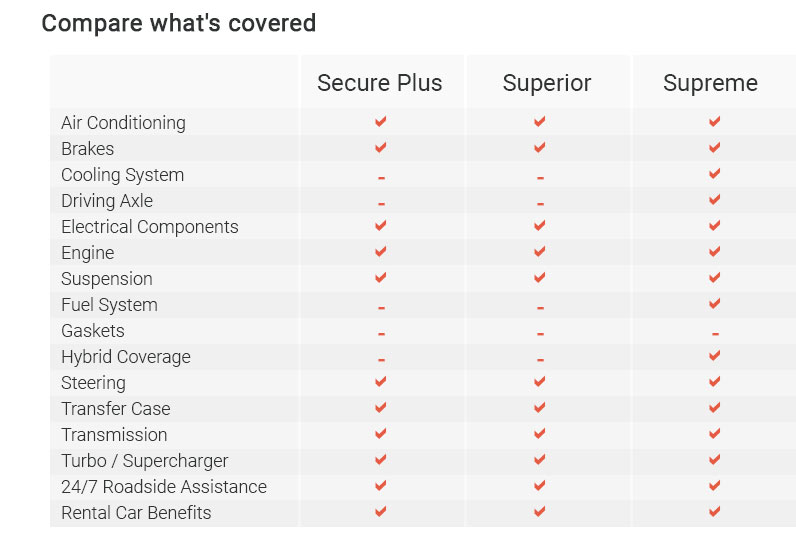

- Powertrain: engine, transmission, drive axles.

- Electronics: sensors, infotainment modules, ECUs.

- Cooling and fuel: pumps, radiators, injectors.

- Steering and suspension: racks, control arms, air struts.

- Extras: roadside assistance, towing, and sometimes rental reimbursement.

Wear items - brakes, wiper blades, tires - usually fall outside the net.

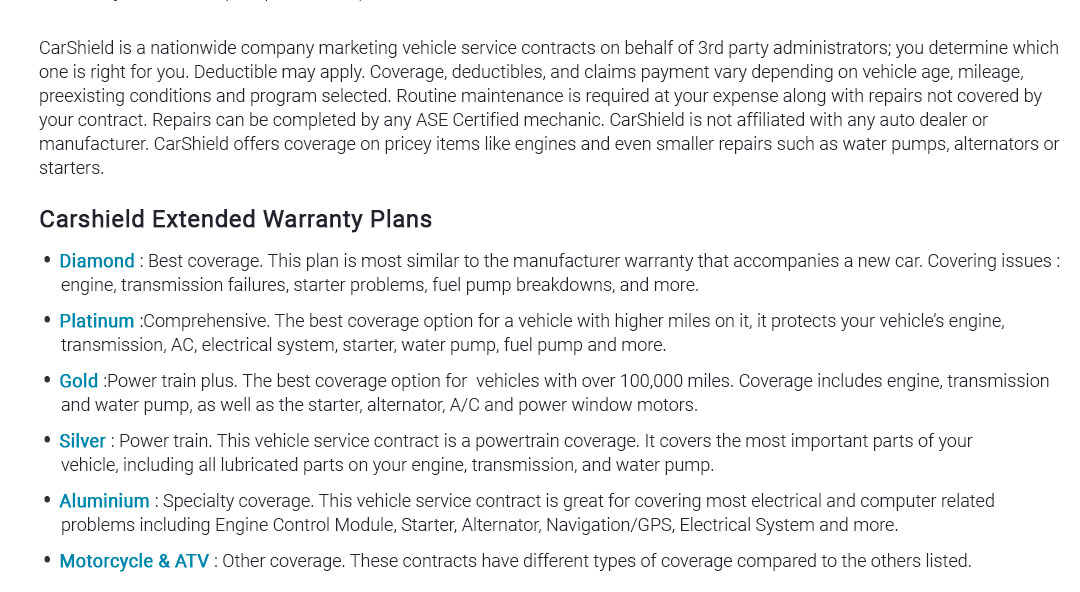

How companies differ

Names vary, but the mechanics are similar. The deltas sit in the fine print.

- Networks: preferred shops speed approvals; open choice may require pre-authorization.

- Parts policy: OEM vs aftermarket vs remanufactured. This matters for fit, safety systems, and resale.

- Diagnostics: some cover scan time; others treat it as your cost unless a covered repair follows.

- Labor rates: capped or "prevailing market." Caps can leave a gap at high-cost urban shops.

- Telematics: select plans use vehicle data to verify failure, shaving hours off approvals.

Safety-first benefits

Done well, coverage is more than bill-paying - it's risk control.

- Verified shops with torque specs, repair procedures, and post-repair road tests.

- Pre/post scans to confirm system health and clear fault codes.

- ADAS calibration after windshield, bumper, or suspension work - small step, big safety gain.

- Recall checks rolled into intake so critical fixes aren't missed.

Costs, deductibles, and limits

Pricing reflects vehicle age, mileage, and tech complexity.

- Deductibles: per visit or per component. Per visit is simpler.

- Coverage caps: per claim and lifetime. Know both numbers.

- Waiting periods: common on new contracts to deter pre-existing failures.

- Rental and towing: daily limits apply; upgrade costs are on you.

Claims workflow

- Breakdown or fault light appears; you contact the carrier or use the app.

- Tow to a network shop or your choice (with authorization).

- Diagnosis written; shop submits estimate with labor times and parts.

- Adjuster approves, revises, or requests teardown photos and scan logs.

- Repair proceeds; payment goes direct to shop minus your deductible.

A quiet real-world moment

Late evening, a battery icon flickered. I pulled into a grocery lot, opened the insurer's app, tapped "tow." Twenty-five minutes later the car was on a flatbed; the alternator test and approval arrived before the shop closed.

Pragmatic caveats

- Missed maintenance can void a claim; keep receipts and service logs.

- Pre-existing issues and modified parts are commonly excluded.

- Parts shortages stretch timelines; rental benefits may end before repairs do.

- Some policies require the failed part to be retained for inspection.

Who might benefit

- High-mileage commuters seeking predictable costs and uptime.

- Owners of tech-heavy vehicles where a single module can exceed a month's rent.

- Used cars just out of factory warranty, especially turbo or air-suspension models.

- Families prioritizing safety checks bundled with repairs.

Questions to ask

- Are diagnostics and calibrations covered or capped?

- What labor rate and shop choice rules apply in my ZIP code?

- Which parts quality is authorized by default, and can I opt for OEM?

- How are wear-related failures handled when they trigger other damage?

- What's the claim cap per visit and across the policy term?

Long-term impact

Consistent, documented repairs protect safety systems today and resale value later. A clean paper trail helps buyers - and you - trust the car at highway speed. Over years, the right policy trades volatility for steady costs; the wrong fit just adds friction.

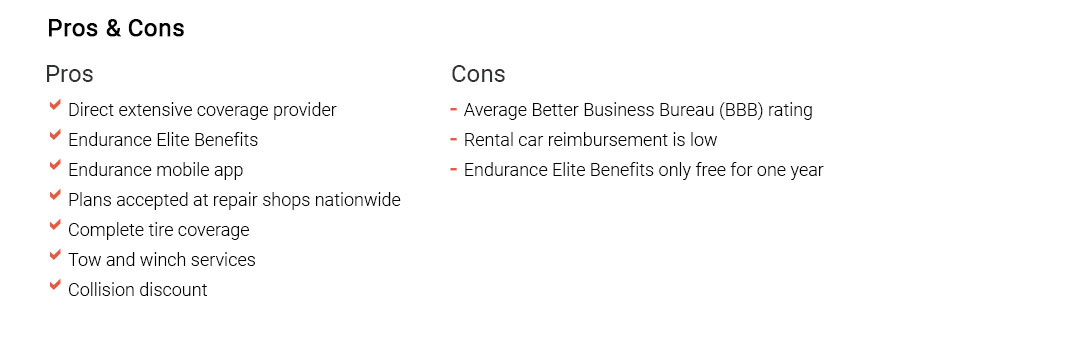

Quick comparison signals

- Transparency: sample contracts online, not just brochures.

- Turnaround: average approval times published by region.

- Calibration coverage: explicit wording for ADAS and post-scan steps.

- Dispute path: escalation beyond the shop advisor, in writing.

Look for a company that treats safety procedures as non-optional, accepts evidence-based diagnostics, and shows its limits up front. Quiet competence beats flashy promises.